The Funded Trader Challenge

The Funded Trader offers a range of trading challenges designed to evaluate traders’ skills and discipline. Our challenges provide Indian traders with the opportunity to prove their trading abilities and gain access to funded accounts. This guide outlines the various challenge types, evaluation criteria, and key information for participants in India.

Types of Challenges

The Funded Trader provides five distinct challenge types, each catering to different trading styles and experience levels:

1. Standard Challenge

2. Rapid Challenge

3. Royal Challenge

4. Knight Challenge

5. Dragon Challenge

Each challenge type has unique features and requirements, allowing traders to choose the option that best suits their trading approach.

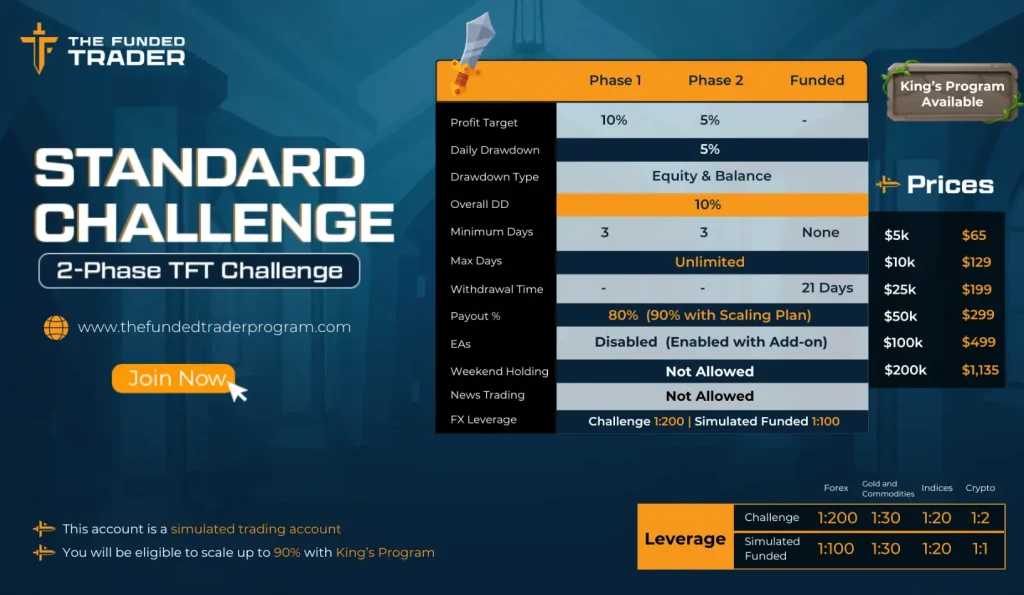

Standard Challenge Overview

The Standard Challenge is our most popular evaluation program. Key features include:

• Two-phase evaluation process

• Account sizes from $415,000 to $33,200,000

• Profit targets: 10% (Phase 1), 5% (Phase 2)

• Maximum daily loss: 5%

• Maximum total loss: 10%

• Minimum trading days: 3 per phase

• Leverage up to 1:200 on forex pairs

This challenge is suitable for traders who prefer a balanced approach to risk and reward.

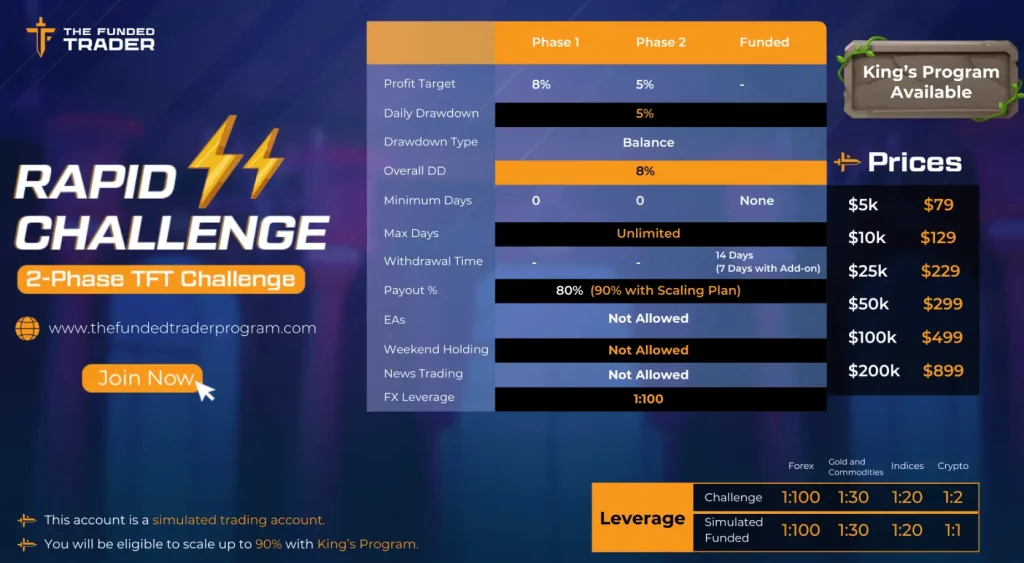

Rapid Challenge Details

The Rapid Challenge is designed for traders seeking a faster evaluation process:

• Two-phase evaluation

• Account sizes from $415,000 to $16,600,000

• Profit targets: 8% (Phase 1), 5% (Phase 2)

• Maximum daily loss: 5%

• Maximum total loss: 8%

• No minimum trading days

• Leverage up to 1:100 on forex pairs

This challenge is ideal for traders confident in their ability to achieve profit targets quickly.

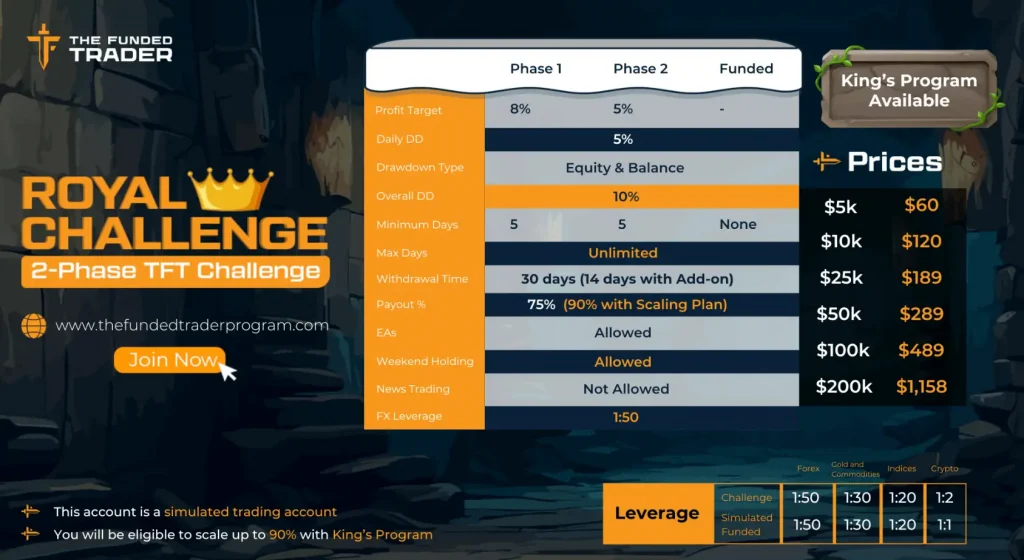

Royal Challenge Specifications

The Royal Challenge offers unique features for experienced traders:

• Two-phase evaluation

• Account sizes from $4,150,000 to $33,200,000

• Profit targets: 8% (Phase 1), 5% (Phase 2)

• Maximum daily loss: 5%

• Maximum total loss: 10%

• Minimum trading days: 5 per phase

• Leverage up to 1:50 on forex pairs

• Expert Advisors (EAs) allowed

This challenge is suitable for traders who use automated trading strategies.

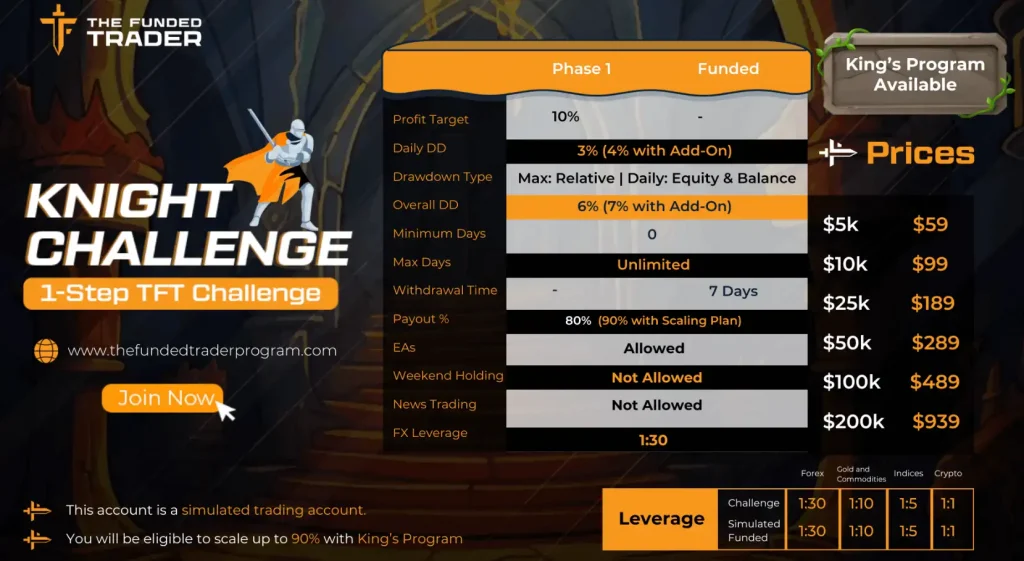

Knight Challenge Structure

The Knight Challenge provides a one-step evaluation process:

• Single-phase evaluation

• Account sizes from $2,075,000 to $16,600,000

• Profit target: 10%

• Maximum daily loss: 3% (4% with add-on)

• Maximum trailing loss: 6% (7% with add-on)

• No minimum trading days

• Leverage up to 1:30 on forex pairs

This challenge is designed for traders who prefer a streamlined evaluation process.

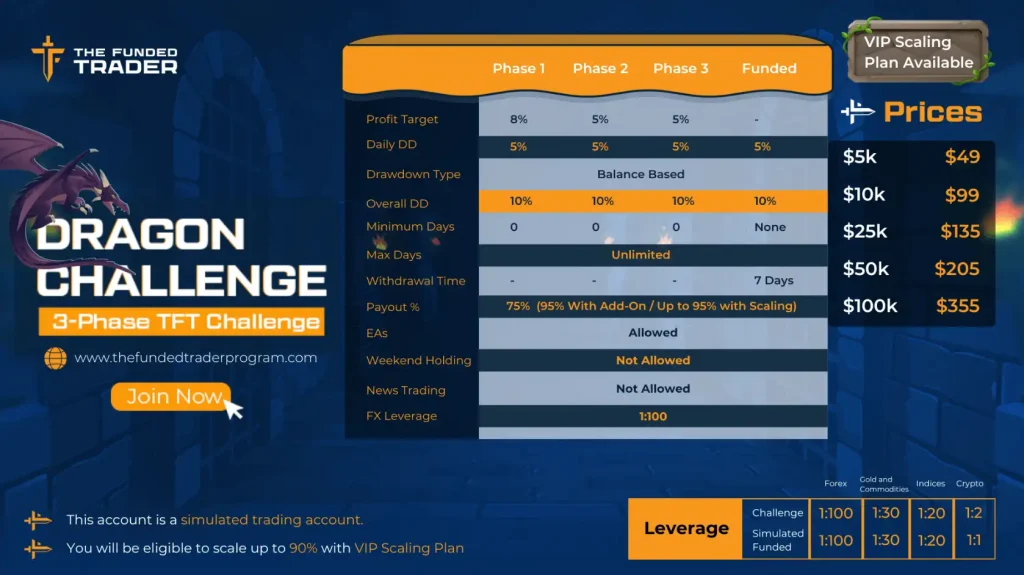

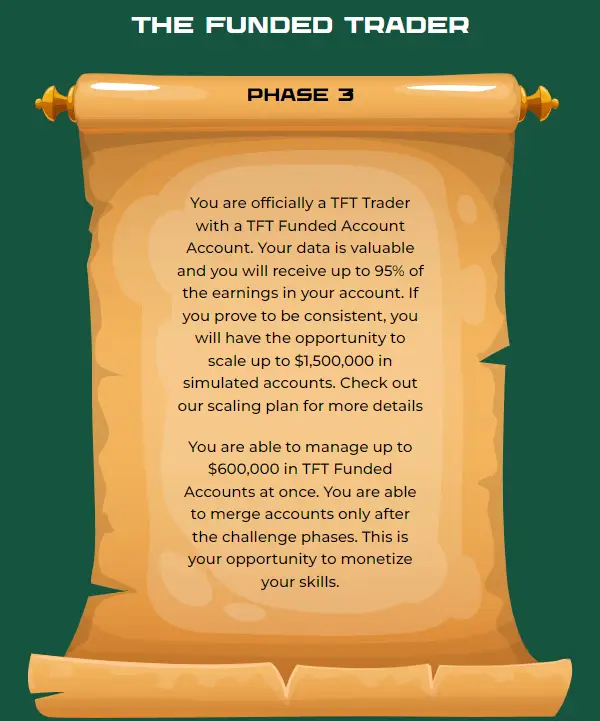

Dragon Challenge Framework

The Dragon Challenge offers a three-phase evaluation:

• Three-phase evaluation process

• Account sizes from $415,000 to $8,300,000

• Profit targets: 8% (Phase 1), 5% (Phase 2), 5% (Phase 3)

• Maximum daily loss: 5% (scalable up to 7%)

• Maximum total loss: 10% (scalable up to 12%)

• No minimum trading days

• Leverage up to 1:100 on forex pairs

This challenge provides a more comprehensive evaluation of trading skills.

Evaluation Criteria

Traders are evaluated based on the following criteria:

• Achievement of profit targets

• Adherence to maximum loss limits

• Compliance with trading rules

• Consistency of trading performance

• Risk management practices

Successful completion of all evaluation phases leads to a funded account offer.

Challenge Rules and Restrictions

Regardless of the challenge type, all participants must adhere to the following rules:

1. No overnight holdings (except for swing accounts)

2. No trading during major news events

3. Adherence to maximum daily and total loss limits

4. Compliance with minimum trading day requirements (if applicable)

5. Use of allowed trading instruments only

6. Observance of lot size restrictions

Violation of these rules may result in disqualification from the challenge.

Challenge Fees and Refunds

| Challenge Type | $415,000 Account | $8,300,000 Account |

| Standard | $5,395 | $41,415 |

| Rapid | $6,555 | $41,415 |

| Royal | N/A | $40,585 |

| Knight | $15,685 | $40,585 |

| Dragon | $4,070 | $29,455 |

Trading Platforms and Instruments

The Funded Trader challenges are conducted on the following platforms:

- Platform 5 via Thaurus LTD

- cTrader via Voyage Markets

- DXtrade via Voyage Markets

Traders can access a wide range of instruments:

- Forex: 40+ currency pairs

- Indices: 9 major global indices

- Commodities: Gold, silver, oil

- Cryptocurrencies (available during challenges only)

Specific instrument availability may vary by challenge type and broker.

Scaling Opportunities

Successful traders have the opportunity to scale their accounts:

• Standard and Royal Challenges: 25% increase every 3 months with consistent profits

• Rapid Challenge: 10% increase per withdrawal over 10% profit

• Maximum account size: $124,500,000

Scaling criteria may vary based on challenge type and trader performance.

Support During Challenges

The Funded Trader provides comprehensive support for challenge participants:

• Detailed challenge guidelines and FAQs

• Customer support via email and live chat

• Trading community forums for peer support

• Regular webinars and educational content

Our support team is available during Indian business hours to assist with any queries.

Post-Challenge Process

Upon successful completion of the challenge:

1. Traders receive a funded account offer

2. KYC verification is required

3. Trading agreement must be signed

4. Initial challenge fee is refunded

5. Funded account is activated within 24-48 hours

Funded traders then begin trading with The Funded Trader’s capital, keeping up to 90% of profits.

Challenge Performance Statistics

Here are some statistics on challenge performance for Indian traders:

• Average pass rate: 12% across all challenge types

• Most popular challenge: Standard Challenge (45% of participants)

• Average time to complete Standard Challenge: 28 days

• Highest success rate: Knight Challenge (18% pass rate)

These statistics are based on data from the past 12 months and are subject to change.

Trader Reviews on Challenges

Here are some reviews from Indian traders regarding The Funded Trader challenges:

“The Standard Challenge provided a good balance of risk and reward. The 10% profit target was challenging but achievable.” – Amit R., Bangalore

“I appreciated the flexibility of the Rapid Challenge. No minimum trading days allowed me to trade according to my strategy.” – Priya S., Mumbai

“The Dragon Challenge was tough, but it thoroughly tested my trading skills. The three-phase process felt comprehensive.” – Rahul K., Delhi

FAQ

Can I retry a challenge if I fail to meet the profit target?

Yes, you can retry the challenge by purchasing a new one. Some account types offer free retries under certain conditions. Check the specific rules for your chosen challenge type.

Are there any restrictions on trading strategies during the challenge?

While we allow most trading strategies, we prohibit arbitrage, news sniping, and excessive risk-taking. Expert Advisors (EAs) are allowed only in the Royal Challenge. Review our full list of permitted and prohibited strategies before starting your challenge.

How long do I have to complete each phase of the challenge?

The time limit varies by challenge type. Standard and Royal Challenges have no maximum time limit but minimum trading day requirements. Rapid and Knight Challenges have no time restrictions. The Dragon Challenge allows unlimited time for each phase. Focus on meeting the profit target while adhering to risk management rules rather than rushing to complete the challenge.